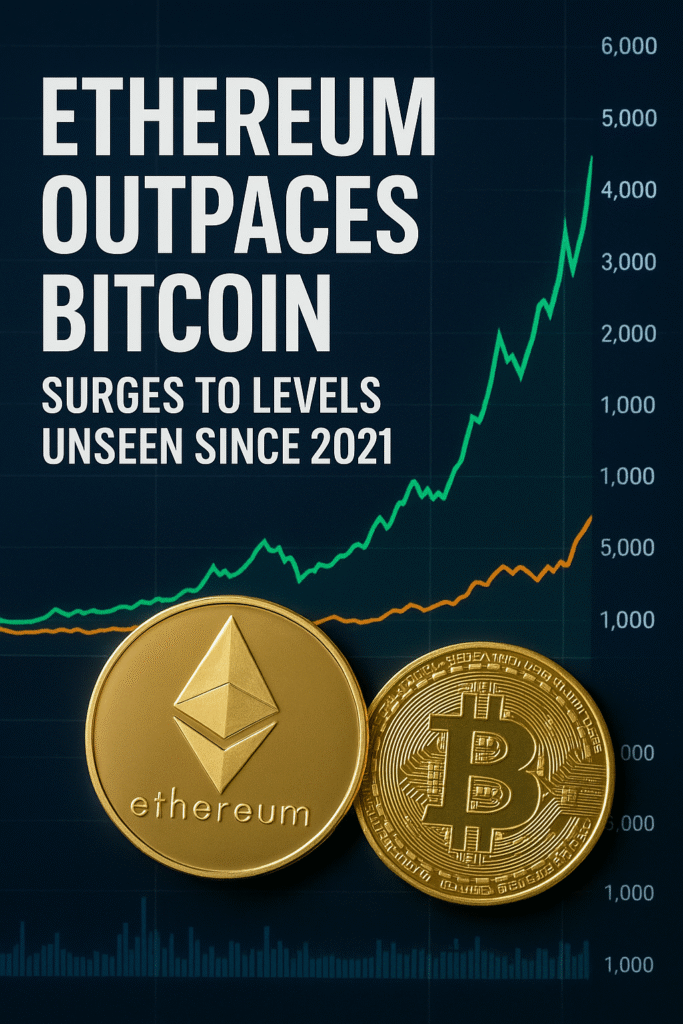

Premium Biz Post – After years of volatility, Ethereum (ETH) has once again taken center stage in the crypto world. In mid-2025, the second-largest cryptocurrency by market capitalization surged to levels unseen since 2021, surpassing expectations and drawing comparisons to Bitcoin’s own price movement. Yet what makes this rally stand out is that Ethereum is not just following Bitcoin—it’s outpacing it. The question on every investor’s mind is simple: what’s driving Ethereum far beyond Bitcoin this time?

A Quick Recap: Ethereum’s Journey Since 2021

Back in late 2021, Ethereum reached its all-time high of nearly $4,900, fueled by the boom in decentralized finance (DeFi) and the explosion of non-fungible tokens (NFTs). But as the global economy tightened and interest rates soared, risk assets—including cryptocurrencies—experienced a sharp decline Like Bitcoin, lost more than 70% of its value by 2022.

The years that followed were marked by recovery, innovation, and a growing distinction between Ethereum’s utility-driven ecosystem and Bitcoin’s digital gold narrative. Fast forward to 2025, Ethereum’s price surge signals not just a comeback, but a new era of dominance fueled by adoption, technology upgrades, and institutional confidence.

Key Drivers Behind Ethereum’s Recent Surge

Unlike Bitcoin, which primarily thrives on scarcity and the narrative of being a hedge against inflation, Ethereum’s value is tied to real-world utility. The latest rally is being driven by multiple powerful factors that highlight why Ethereum is pulling ahead.

1. Institutional Adoption of Ethereum-Based Applications

While Bitcoin remains the entry point for many institutions, Ethereum is where the action is happening. Financial giants, including asset managers and tech firms, are increasingly using for tokenized assets, smart contracts, and blockchain-based financial products.

Recently, tokenization of real-world assets—such as bonds, stocks, and real estate—has gained massive traction. BlackRock, Fidelity, and other major players have launched pilots for tokenized funds on Ethereum. This surge in adoption has positioned Ethereum as the backbone of institutional-grade blockchain infrastructure.

2. Ethereum ETFs Fueling Demand

One of the strongest catalysts has been the approval and growth of Ethereum Exchange-Traded Funds (ETFs) across multiple regions. After years of lobbying, regulators in the U.S. and Europe finally opened the door for Ethereum ETFs, mirroring Bitcoin’s success but with greater investor enthusiasm.

The difference? Ethereum ETFs don’t just track price—they’re also tied to Ethereum’s staking yields, giving institutional investors a double incentive: price appreciation and passive income. This has led to inflows that exceed early Bitcoin ETF demand.

3. The Power of Staking and Yield Generation

Ethereum’s transition to Proof-of-Stake (PoS) in 2022 fundamentally changed its economics. Unlike Bitcoin, which relies on energy-intensive mining, Ethereum allows investors to stake their ETH to secure the network and earn yields in return.

Currently, staking offers annual returns between 3% to 5%, making Ethereum an income-generating asset—a critical distinction for traditional investors seeking long-term holdings. With more than 30% of ETH supply now staked, scarcity on exchanges is increasing, amplifying upward price pressure.

4. Ethereum as the Hub of Web3 and DeFi

Bitcoin may dominate headlines as digital gold, but Ethereum remains the heartbeat of Web3 innovation. From DeFi protocols enabling peer-to-peer lending, to NFT marketplaces and decentralized autonomous organizations (DAOs), Ethereum’s ecosystem continues to grow exponentially.

In 2025, Layer-2 scaling solutions like Arbitrum, Optimism, and zkSync have matured, significantly lowering transaction costs and increasing network efficiency. This scalability breakthrough ensures that Ethereum can support mainstream adoption without the bottlenecks that plagued it in earlier years.

5. Bitcoin’s Stagnation in Innovation

Another reason Ethereum is outperforming Bitcoin lies in Bitcoin’s design. While Bitcoin is unmatched in terms of security and scarcity, its lack of programmability limits its use cases. Ethereum, on the other hand, is constantly evolving through upgrades like The Merge and the upcoming Danksharding protocol, which promise even greater scalability and lower costs.

In other words, Bitcoin is a store of value, but Ethereum is becoming the infrastructure for the digital economy.

read more : “Shell Jewelry Trends Sustainable Style with Coastal Soul“

Why Ethereum’s Rally Feels Different This Time

Ethereum’s current surge is not just another speculative bubble. Unlike the 2021 bull run, which was driven largely by hype around NFTs and meme coins, today’s momentum has fundamental backing. Here’s why:

- Broader Investor Base: Institutions, hedge funds, and even governments are entering the Ethereum ecosystem.

- Utility-Driven Growth: Real-world applications like supply chain tracking, gaming, and finance are built on Ethereum.

- Reduced Volatility from Staking: With a large portion of ETH locked in staking, supply shocks stabilize price action.

- Global Regulation Clarity: Regulatory acceptance of Ethereum ETFs and staking frameworks has reduced uncertainty.

This combination makes Ethereum’s growth more sustainable and less dependent on retail-driven speculation.

Ethereum vs. Bitcoin: Diverging Narratives

Bitcoin and Ethereum now represent two distinct narratives in crypto:

- Bitcoin: The ultimate hedge, a scarce digital asset likened to gold.

- Ethereum: The digital economy’s operating system, powering innovation and financial transformation.

While Bitcoin remains crucial as a store of value, Ethereum’s multi-dimensional use cases give it a wider growth trajectory. The fact that Ethereum is outperforming Bitcoin in this rally underscores that investors are no longer just betting on scarcity—they’re betting on utility.

Potential Risks That Could Slow Ethereum’s Momentum

Despite the optimism, it’s important to recognize that risks remain. Ethereum’s rise is not guaranteed to continue unchecked. Key challenges include:

- Regulatory Scrutiny: Governments may impose stricter rules on staking yields or DeFi platforms.

- Competition: Other blockchains like Solana, Avalanche, and Cardano continue to innovate and attract users.

- Scalability Pressure: Even with Layer-2 solutions, Ethereum must keep up with global demand.

- Market Volatility: Macroeconomic shifts, such as interest rate hikes or recessions, can impact crypto prices across the board.

These risks don’t negate Ethereum’s momentum but serve as reminders that the road ahead is still evolving.

The Bigger Picture: Ethereum Leading the Next Digital Wave

Ethereum’s resurgence above its 2021 levels isn’t just about price—it’s about relevance. The crypto industry is moving from a speculative era to one driven by real-world adoption, and sits at the center of it all.

From powering decentralized finance to enabling the tokenization of global assets worth trillions, building an ecosystem that could transform how money, ownership, and data work in the digital age. While Bitcoin paved the way, may ultimately define the next phase of blockchain history.