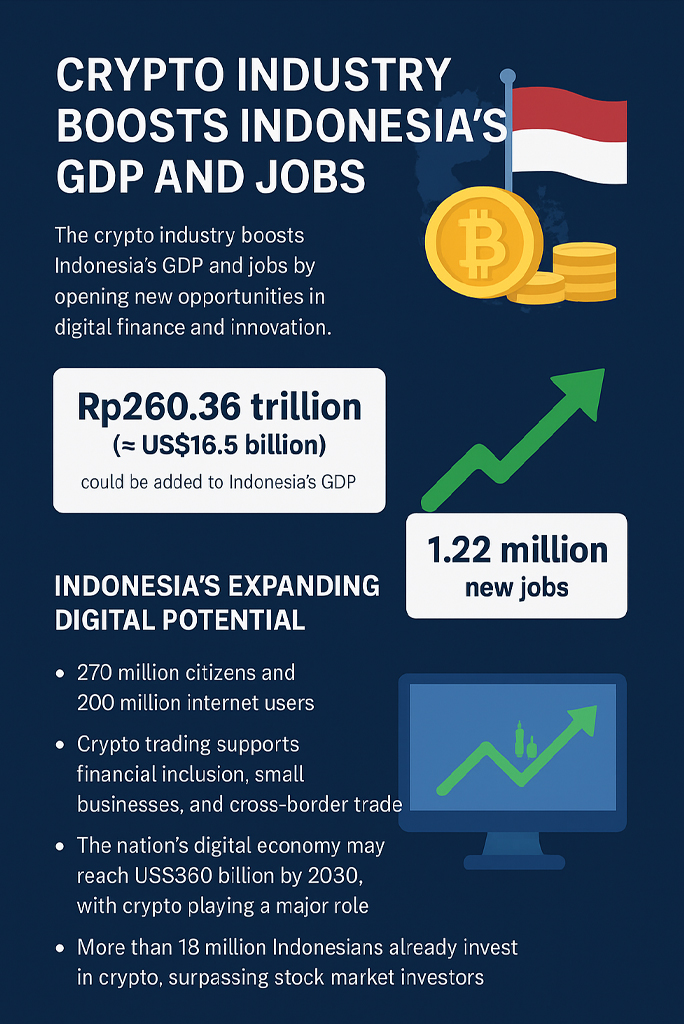

Premium Biz Post – The crypto industry boosts Indonesia’s GDP and jobs by opening new opportunities in digital finance and innovation.

A study from the Institute for Economic and Social Research (LPEM FEB UI) found that cryptocurrency could add Rp260.36 trillion (≈ US$16.5 billion) to Indonesia’s GDP. It could also create 1.22 million new jobs across various sectors.

This finding positions Indonesia as one of the fastest-growing digital economies in Southeast Asia. Blockchain, fintech, and digital trading are now central to this transformation.

Indonesia’s Expanding Digital Potential

Indonesia’s digital economy has grown rapidly in the last decade.

With 270 million citizens and 200 million internet users, the country has a vast base for blockchain adoption.

Crypto trading is no longer seen only as speculation. It now supports financial inclusion, small businesses, and cross-border trade.

The nation’s digital economy may reach US$360 billion by 2030, and crypto will play a major role in that growth.

More than 18 million Indonesians already invest in crypto — a number higher than stock market investors. This shift marks a clear sign of growing trust in digital assets.

Government Steps and Regulation

The government sees the crypto industry as both a challenge and an opportunity.

Through Bappebti under the Ministry of Trade, Indonesia regulates the fast-growing crypto market.

Plans for a National Crypto Exchange were announced in 2024. This exchange will improve transparency, protect users, and help collect tax revenue.

It will also make trading safer and easier to monitor.

Bank Indonesia and the Financial Services Authority (OJK) are also strengthening policies to prevent fraud and ensure market stability.

These actions show that Indonesia is serious about building a secure and sustainable digital economy.

Job Creation and Economic Impact

The LPEM report highlighted an impressive number — 1.22 million potential new jobs.

Blockchain-based businesses need developers, cybersecurity experts, analysts, marketers, and compliance officers.

Startups and crypto platforms are hiring rapidly.

They are also working with universities to train students in blockchain and data skills.

The Indonesian Blockchain Association (ABI) partners with schools to improve education and certification programs.

These initiatives help prepare local talent for the digital future.

Read More : ”From Trash to Treasure Turning Waste into Profit’‘

Startups Driving Innovation

Indonesia’s startup scene is thriving.

Companies like Pintu, Indodax, and Rekeningku lead the local crypto trading industry.

Beyond trading, many firms use blockchain for supply chains, logistics, and agriculture.

Coffee exporters, for example, use blockchain to track beans from farms to customers.

This traceability builds trust and supports global trade.

In the fintech sector, blockchain reduces costs for remittances and cross-border payments.

This is vital for millions of Indonesians working abroad.

Tokenized assets and NFTs are also creating new investment opportunities for young investors.

Challenges for the Industry

Despite strong growth, problems remain.

Regulation is still developing, and investors often face unclear tax rules.

A clearer legal framework would attract more long-term investors.

Financial literacy is another key issue.

Millions of Indonesians trade crypto but don’t fully understand blockchain or its risks.

Without proper education, they may fall into scams or suffer losses during market volatility.

Sustainability is also becoming important.

Mining consumes a lot of energy.

Indonesia must move toward proof-of-stake and other eco-friendly technologies to minimize environmental impact.

Investment and Future Growth

Indonesia’s young, tech-savvy population makes it ideal for crypto innovation.

Venture capital investments in local fintech firms continue to rise, with some exceeding US$100 million in 2025.

International players from Japan, South Korea, and the Middle East are exploring partnerships in blockchain and digital assets.

These collaborations bring capital, expertise, and market access.

The government’s plan for a Digital Rupiah (CBDC) will strengthen Indonesia’s role in regional fintech.

Integrating blockchain into the national payment system could also boost efficiency and transparency.

Public Perception and Inclusion

Public attitudes toward crypto have shifted.

It is no longer viewed only as a risky bet.

Many see it as a tool for financial freedom and inclusion.

Young people, especially millennials and Gen Z, are leading adoption.

They use digital wallets, invest in tokens, and support local blockchain projects.

Crypto has also improved financial access in rural areas.

People with limited banking options can now save and transfer money digitally.

This supports Indonesia’s vision of financial inclusion for all by 2025.

Events like Blockchain Week Jakarta and Indonesia Fintech Festival help connect innovators, investors, and regulators.

They also promote awareness and responsible use of crypto.

Indonesia on the Global Stage

Globally, Indonesia is now among the top 10 countries for crypto adoption, according to Chainalysis.

Affordable internet, mobile access, and a young population drive this success.

Unlike Singapore, which focuses on institutional finance, Indonesia’s strength lies in mass adoption.

Millions of small users create a strong and dynamic market base.

With a balanced policy approach — supporting innovation while managing risk — Indonesia is earning global recognition.

Experts predict that the nation could soon become a regional leader in crypto-based jobs and GDP growth.

Indonesia’s crypto journey is just beginning.

With the right mix of education, regulation, and investment, the sector can transform the nation’s economy.

The LPEM study shows that crypto is not just speculation.

It is a real economic engine that can drive innovation and employment.

Collaboration between the private sector and government is essential.

Policies must support growth while protecting investors and the environment.

If these steps succeed, Indonesia could lead Asia in digital finance.

The combination of talent, population, and innovation makes this future achievable.

Indonesia’s crypto sector is moving from hype to real economic impact.

With billions in potential GDP and over a million new jobs, its influence is undeniable.

Handled responsibly, the crypto industry boosts Indonesia’s GDP and jobs while reshaping the nation’s digital future.

The opportunity is massive — and Indonesia is ready to seize it.