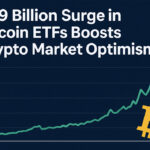

Premium Biz Post – In recent weeks, the global cryptocurrency market has witnessed a massive inflow of funds totaling $1.9 billion, with Bitcoin Exchange-Traded Funds (ETFs) playing a dominant role in driving this surge. The rise signals a renewed wave of investor confidence and institutional participation in digital assets. The keyword Crypto Fund Surge perfectly captures the growing enthusiasm among traders and financial institutions embracing Bitcoin as a legitimate investment vehicle.

The Rise of Bitcoin ETFs in 2025

Bitcoin ETFs have become one of the most influential financial products in the cryptocurrency market. By providing a bridge between traditional finance and digital assets, these funds allow investors to gain exposure to Bitcoin without the complexities of directly buying or storing it. Since their approval in major financial hubs such as the United States and Europe, Bitcoin ETFs have rapidly accumulated billions in assets under management (AUM).

The latest data shows that U.S.-based Bitcoin ETFs contributed to the majority of the recent inflows, accounting for nearly 80% of the $1.9 billion. Major players like BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), and ARK 21Shares Bitcoin ETF have seen unprecedented demand from institutional investors. These funds provide transparency, liquidity, and regulation—key factors that attract conservative investors previously hesitant to enter the crypto space.

According to CoinShares, this is the largest inflow of capital since early 2021, marking a pivotal moment as investors reposition their portfolios in anticipation of a global monetary policy shift.

Macroeconomic Factors Behind the Surge

The rise in Bitcoin ETF inflows can be traced to a mix of macroeconomic and regulatory developments. The recent interest rate cuts by the U.S. Federal Reserve have reignited interest in risk-on assets like cryptocurrencies. As yields on traditional bonds decline, investors are turning toward alternative stores of value such as Bitcoin.

Moreover, inflationary pressures in major economies continue to drive the narrative of Bitcoin as a hedge against fiat currency devaluation. Institutional investors, including hedge funds and pension managers, are increasingly diversifying their portfolios with digital assets, considering Bitcoin’s long-term growth potential.

The geopolitical climate has also played a role. With growing uncertainty in global trade and rising tensions in financial markets, Bitcoin’s decentralized nature and limited supply make it an appealing safe-haven asset. Analysts note that the correlation between Bitcoin and gold has strengthened in 2025, reinforcing the perception of Bitcoin as “digital gold.”

Institutional Confidence and Retail Adoption

Institutional interest in Bitcoin ETFs has grown substantially in 2025. Unlike in previous market cycles, this surge is driven less by retail speculation and more by strategic portfolio diversification by large-scale investors. Reports indicate that over 70% of recent inflows into Bitcoin ETFs come from institutions seeking exposure through regulated products.

BlackRock, Fidelity, and ARK have each reported record-breaking inflows from corporate clients. According to Bloomberg Intelligence, institutional investors now account for over $50 billion in Bitcoin ETF assets globally, marking a 40% increase year over year.

At the same time, retail investors are following the trend. The accessibility of ETFs on popular trading platforms like Robinhood, Charles Schwab, and Fidelity Investments has made Bitcoin exposure easier than ever. Retail participation has helped sustain market momentum and maintain trading volumes even during periods of volatility.

Read More : ”Bamboo Wind Chime The Harmony of Nature with Artistic”

Market Sentiment and Price Impact

The increase in Bitcoin ETF inflows has had a notable impact on market sentiment. Bitcoin’s price has remained resilient, holding steady above the $60,000 mark despite short-term volatility. Analysts suggest that consistent inflows into ETFs have created a strong underlying demand base, cushioning the cryptocurrency from larger sell-offs.

Market strategist Michael Saylor of MicroStrategy has reiterated his bullish stance, noting that Bitcoin’s scarcity and increasing institutional adoption create a long-term “supply shock.” As more Bitcoin is locked within ETF structures, the circulating supply available for trading diminishes—potentially setting the stage for a major price rally in late 2025.

Ethereum and other altcoins have also benefited indirectly from the Bitcoin ETF momentum. With the spotlight on Bitcoin, investors are diversifying into other blockchain-based assets, driving modest gains across the broader crypto market.

Regulatory Developments Boosting Investor Trust

The regulatory landscape has played a crucial role in legitimizing Bitcoin ETFs and the broader crypto ecosystem. In the United States, the Securities and Exchange Commission (SEC) recently approved new guidelines to simplify ETF listings and enhance market transparency. These reforms have attracted both traditional asset managers and fintech innovators to launch digital asset-based products.

In Europe, regulators have followed a similar path. The European Securities and Markets Authority (ESMA) has endorsed several Bitcoin ETFs under the Markets in Crypto-Assets (MiCA) framework, ensuring uniform compliance and investor protection across EU member states.

Meanwhile, Asian markets are catching up. Japan, Singapore, and Hong Kong have each taken steps toward creating regulated frameworks for crypto investment products. Analysts believe this global shift toward clearer regulations will further accelerate institutional participation and enhance market stability.

Technology and Security in ETF Infrastructure

One of the key factors contributing to the success of Bitcoin ETFs is the advancement in blockchain security and custodial technology. Leading custodians such as Coinbase Custody, BitGo, and Gemini Trust provide multi-signature wallets, insurance protection, and regulatory oversight—addressing previous concerns about asset safety.

Additionally, blockchain auditing tools now allow real-time verification of fund holdings, ensuring transparency for investors and regulators alike. The combination of institutional-grade security and regulatory compliance has significantly increased investor confidence, making ETFs a preferred gateway for crypto exposure.

The Broader Impact on the Crypto Ecosystem

The ongoing crypto fund surge has broader implications beyond Bitcoin. It signals growing maturity in the digital asset market, where regulatory clarity and institutional involvement drive sustainable growth instead of speculative hype.

This new wave of capital is also fostering innovation. Startups developing blockchain-based financial products—such as tokenized bonds, decentralized ETFs, and real-world asset tokenization—are gaining momentum. Venture capital investment in blockchain technology surpassed $20 billion in 2025, reflecting optimism about long-term adoption.

The liquidity provided by Bitcoin ETFs also benefits the overall crypto ecosystem by stabilizing prices and improving market efficiency. With increased trading volume and reduced volatility, both retail and institutional investors can operate in a more predictable market environment.

Challenges and Risks Ahead

Despite the optimism, challenges remain. Market analysts warn that the rapid inflow of funds could lead to short-term overheating, particularly if speculative traders dominate ETF markets. Regulatory scrutiny is likely to intensify as authorities ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) standards.

Moreover, Bitcoin’s volatility continues to be a concern for conservative investors. While ETFs provide a regulated entry point, they cannot fully eliminate market risk. Sudden macroeconomic shocks, such as geopolitical tensions or policy reversals, could still trigger significant price corrections.

Another key issue is the growing competition among ETF issuers. With multiple funds vying for investor attention, management fees are falling rapidly. While this benefits investors, it may squeeze profit margins and limit innovation among smaller asset managers.

Outlook for 2026 and Beyond

Looking ahead, analysts predict that Bitcoin ETFs will continue to attract strong inflows, particularly if global central banks maintain accommodative monetary policies. The integration of Bitcoin ETFs into retirement portfolios and wealth management products is expected to increase adoption further.

Furthermore, the introduction of Ethereum and multi-asset crypto ETFs could expand the market beyond Bitcoin, offering investors diversified exposure to blockchain technologies. As the digital economy evolves, the line between traditional finance and decentralized finance (DeFi) will blur, creating new opportunities for both institutional and retail participants.

The Crypto Fund Surge phenomenon represents more than just a temporary market rally—it reflects a structural transformation in global finance. As blockchain technology gains legitimacy and mainstream acceptance, Bitcoin ETFs are likely to remain at the forefront of this evolution, serving as a bridge between innovation and investment.