Premium Biz Post – In recent years, the financial world has witnessed a significant shift in how younger generations approach investing. Traditional assets like stocks, bonds, and real estate are no longer the only players on the field. Instead, a growing number of Millennials and Gen Z investors are turning to digital assets, especially cryptocurrency. This shift raises a compelling question: Why Cryptocurrency Is the Young Generation’s Digital Investment Choice?

Digital Natives in a Digital Economy

Millennials and Gen Z have grown up surrounded by technology. Unlike previous generations, they have witnessed the rapid digital transformation of almost every aspect of life—communication, education, shopping, and now, finance. For digital natives, adopting cryptocurrency feels like a natural evolution in their economic engagement.

Cryptocurrencies like Bitcoin, Ethereum, and Solana operate on blockchain technology, which offers decentralization, transparency, and autonomy. These qualities align with the values of younger investors who tend to be skeptical of traditional financial institutions. The 2008 financial crisis, for instance, left a lasting impression, creating a level of distrust in centralized banking systems. Cryptocurrency presents an appealing alternative—one where users can control their assets directly without intermediaries.

read more : “Natural Coffee Scrub: Secret to Beauty Without Chemicals“

Accessibility and Low Entry Barriers

One of the most attractive aspects of cryptocurrency for young investors is its accessibility. Traditional investments often require significant capital to start, along with an understanding of complex systems and gatekeeping mechanisms like brokers and institutional processes. In contrast, crypto trading platforms are user-friendly and open 24/7, offering the ability to start investing with just a few dollars.

Apps like Coinbase, Binance, and Kraken allow users to buy fractional shares of digital currencies, making it possible to own a portion of a Bitcoin or Ethereum without needing thousands of dollars. This flexibility is particularly attractive to young adults who may be navigating student debt, early career earnings, and high living costs.

Financial Education and Online Communities

Another driving force behind the young generation’s interest in crypto is the rise of financial education through social media. Platforms like Reddit, Twitter (now X), YouTube, and TikTok host vibrant communities where users share insights, analyze trends, and offer tutorials.

This democratization of knowledge empowers younger investors to make informed decisions without relying solely on traditional financial advisors. The “learn-and-earn” culture of cryptocurrency—where platforms offer rewards for completing educational modules—also plays a vital role in building confidence and competence in digital asset investing.

High Risk, High Reward Mentality

The younger generation tends to be more risk-tolerant, especially when it comes to long-term gains. Many of them see crypto as a high-risk, high-reward opportunity that could potentially generate wealth at a faster pace than conventional methods.

While this approach isn’t without its dangers—cryptocurrency markets are notoriously volatile—it reflects a broader shift in investment psychology. The dream of financial freedom, early retirement, or even just beating inflation pushes younger investors to explore alternatives outside the status quo.

They’re also drawn to the idea of being part of something new and revolutionary. Investing in cryptocurrency isn’t just about profits; it’s also about participating in what could be the next major financial paradigm.

Ethical and Ideological Appeal

There’s also an ideological component to the rise of crypto among young people. Many see cryptocurrency as a tool for social and financial empowerment. Decentralized finance (DeFi) systems allow individuals to lend, borrow, and earn interest without involving banks. This aligns with the younger generation’s values of autonomy, transparency, and fairness.

Additionally, certain cryptocurrencies and blockchain projects focus on environmental sustainability, charitable giving, and social justice—causes that deeply resonate with socially conscious young investors.

For example, projects like Ethereum’s shift to Proof-of-Stake (PoS) significantly reduced energy consumption, addressing environmental concerns tied to older blockchain models. These initiatives create a sense of purpose and impact, transforming cryptocurrency from a mere investment into a meaningful endeavor.

Global Reach and Borderless Opportunities

Cryptocurrency knows no borders. This is especially appealing to a generation that is more global-minded than ever. Many Millennials and Gen Zers are digital nomads or aspire to become one. They value the flexibility of assets that aren’t tied to a specific country or banking system.

Crypto wallets and exchanges operate globally, allowing users to send and receive money instantly, regardless of location. This global accessibility opens up opportunities in emerging markets and allows for participation in worldwide financial trends.

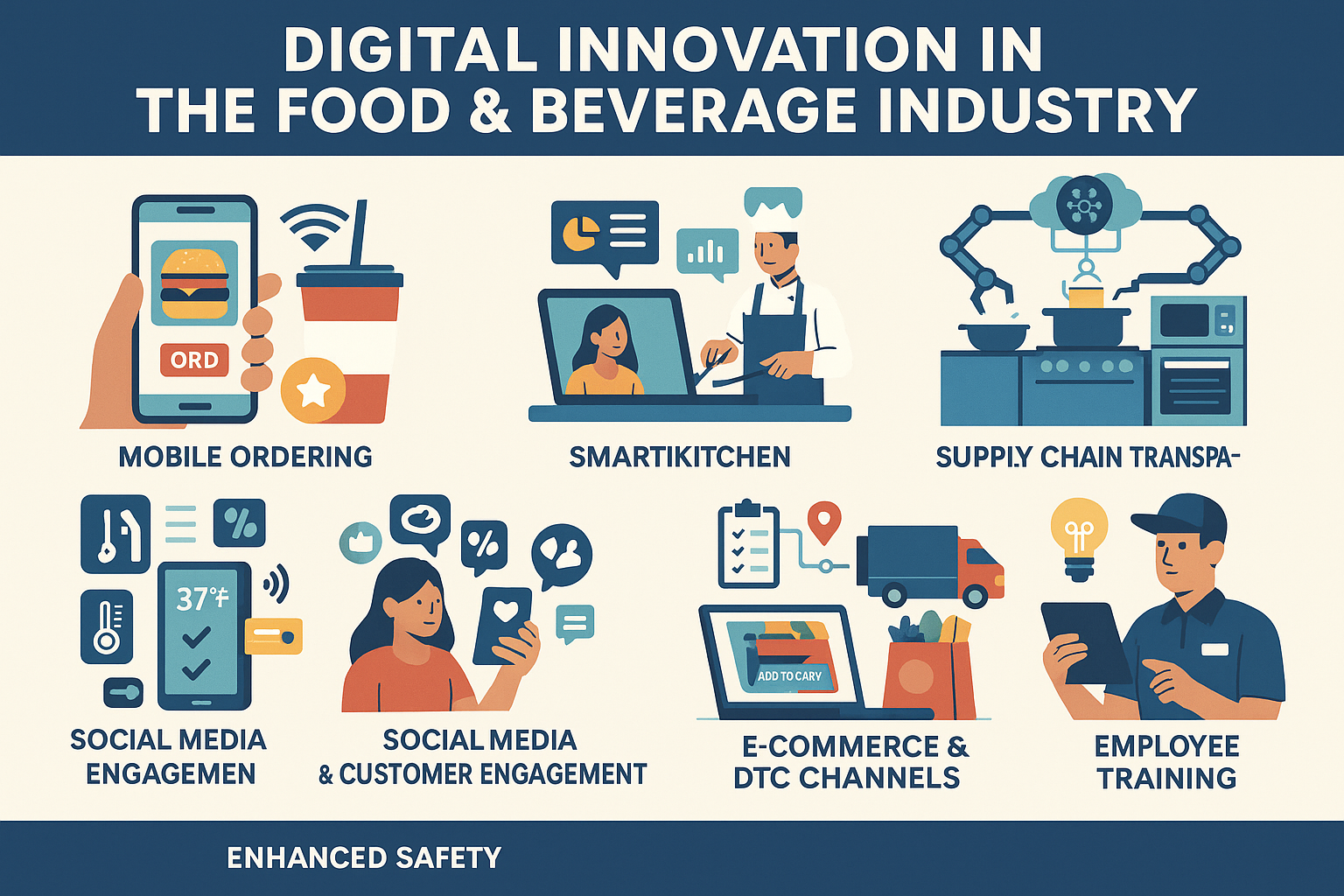

Technological Curiosity and Innovation

Curiosity about emerging technology also fuels the younger generation’s interest in crypto. From NFTs (Non-Fungible Tokens) to DAOs (Decentralized Autonomous Organizations), the world of cryptocurrency is constantly evolving. Young investors are often at the forefront of adopting and experimenting with these innovations.

They don’t just invest in coins; they interact with ecosystems, test decentralized apps (dApps), participate in governance, and even create digital assets. This hands-on involvement provides a sense of ownership and immersion that traditional investment tools rarely offer.

Challenges and Considerations

Despite the enthusiasm, it’s important to acknowledge that cryptocurrency is not a guaranteed path to wealth. Security risks, market volatility, regulatory uncertainty, and scams are real challenges that require caution and awareness.

Young investors must prioritize cybersecurity practices such as using hardware wallets, enabling two-factor authentication, and verifying the credibility of platforms. Moreover, as governments and financial authorities continue to develop regulations, staying informed about legal implications is crucial.

Long-Term Outlook

Still, the long-term outlook for cryptocurrency remains optimistic. As adoption increases and technology matures, the infrastructure supporting digital assets becomes more robust. Institutional interest, like that from BlackRock, Fidelity, and PayPal, is helping legitimize the space and improve market stability.

For the younger generation, who have decades of investing ahead of them, early adoption of cryptocurrency could be a strategic move. With the right education, discipline, and diversification, digital assets can complement a broader investment portfolio.