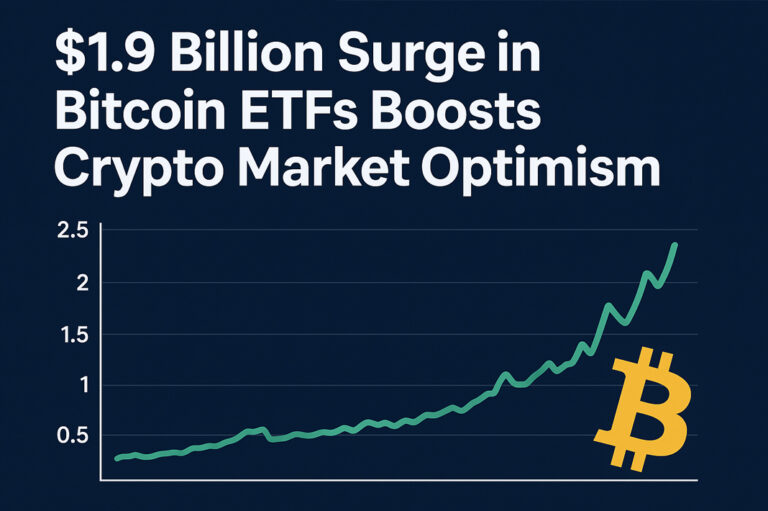

Premium Biz Post – The cryptocurrency market witnessed a remarkable rebound last week as Bitcoin exchange-traded funds (ETFs) recorded a staggering $1.9 billion inflow, signaling renewed confidence among institutional investors. This surge in capital has not only fueled a bullish sentiment across digital assets but also reaffirmed Bitcoin’s growing appeal as a mainstream financial instrument.

Over the past few months, the digital asset sector has faced a wave of volatility—driven by macroeconomic pressures, regulatory uncertainties, and shifts in investor sentiment. Yet, despite the turbulence, Bitcoin ETFs have emerged as a stabilizing force, providing traditional investors with a regulated gateway into crypto exposure. The recent inflow represents one of the largest single-week investments since spot Bitcoin ETFs were approved earlier this year, according to data from CoinShares and Bloomberg Intelligence.

Institutional Interest Returns to Crypto

The $1.9 billion surge marks a pivotal moment for the cryptocurrency market. Analysts note that such strong institutional interest often serves as a precursor to broader market rallies. Bitcoin, in particular, saw a rise of nearly 6% following the inflows, briefly reclaiming key resistance levels above $68,000 before stabilizing.

Institutional investors appear to be regaining confidence in digital assets as inflation cools and the U.S. Federal Reserve hints at potential rate cuts. With risk appetite returning to global markets, crypto—especially Bitcoin—is once again seen as a high-reward diversification tool within balanced portfolios.

James Butterfill, Head of Research at CoinShares, explained in a recent report, “This latest wave of inflows indicates a renewed appetite for digital assets, led by Bitcoin ETFs, which continue to attract long-term institutional capital.”

The Role of Bitcoin ETFs in Market Maturity

Since their introduction, Bitcoin ETFs have played a transformative role in bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi). They allow investors—especially large institutions such as pension funds, hedge funds, and asset managers—to gain exposure to Bitcoin without directly handling digital wallets or facing the security risks of crypto exchanges.

The $1.9 billion surge in Bitcoin ETFs boosts crypto market optimism, but it also highlights the broader evolution of crypto as a legitimate asset class. ETFs offer regulated transparency, professional management, and liquidity—factors long sought by cautious institutional investors.

Experts believe that this growing adoption signals a shift from speculative trading to strategic allocation. Institutional investors are no longer viewing Bitcoin as a short-term gamble but as a hedge against macroeconomic instability and fiat currency depreciation.

Regulatory Clarity Drives Momentum

Regulation has historically been one of the major obstacles for cryptocurrency adoption. However, recent developments in the United States, the European Union, and Asia have provided much-needed clarity for digital asset products. The U.S. Securities and Exchange Commission (SEC), after years of hesitation, approved multiple spot Bitcoin ETFs, opening the door for widespread institutional participation.

This regulatory green light not only legitimized Bitcoin in the eyes of traditional investors but also paved the way for innovative financial products tied to digital assets. Similar trends are emerging globally—Europe now hosts its own range of crypto ETFs under MiCA-compliant frameworks, while Asia, particularly Hong Kong and Singapore, is rapidly expanding its crypto-linked product offerings.

According to Bloomberg analysts, these global policy shifts have collectively contributed to the recent inflows. Investors who were previously cautious now view ETFs as a safe and regulated entry point into the crypto market.

Read More : ”Indonesian Handicraft Products A Window to Philosophy and Art of Global Value”

Investor Psychology and Market Sentiment

Market psychology plays a crucial role in cryptocurrency cycles. Historically, strong ETF inflows have coincided with renewed retail enthusiasm and price appreciation. The visibility of Bitcoin ETFs on mainstream trading platforms such as Nasdaq and the NYSE has also increased public awareness and legitimacy.

Investor sentiment metrics, including the “Crypto Fear & Greed Index,” have shifted from “Neutral” to “Greed” in the past week, reflecting growing optimism. On-chain data further shows that long-term holders are accumulating, while short-term traders are reducing selling pressure.

Analysts suggest that this behavioral shift mirrors the early stages of previous bull runs. The combination of institutional inflows, decreasing supply on exchanges, and macroeconomic tailwinds could set the stage for a sustained rally heading into 2026.

Altcoins Benefit from Bitcoin’s Momentum

While Bitcoin remains the dominant beneficiary of ETF inflows, the positive sentiment has spilled over into the broader crypto ecosystem. Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) recorded gains between 3% and 8% during the same week.

Ethereum, in particular, stands to gain further once its own spot ETF receives approval—an event anticipated by many market participants in early 2026. The success of Bitcoin ETFs may serve as a blueprint for other cryptocurrencies seeking institutional legitimacy.

Furthermore, blockchain-related equities such as Coinbase, MicroStrategy, and Marathon Digital have also enjoyed upward momentum, reflecting investor optimism that extends beyond digital coins.

Macroeconomic Factors Supporting the Rally

Several macroeconomic dynamics have aligned in favor of crypto assets. A weaker U.S. dollar, declining Treasury yields, and expectations of monetary easing have collectively bolstered demand for risk assets.

In addition, geopolitical tensions and uncertainty in traditional equity markets are prompting investors to diversify into alternative assets. Bitcoin, often dubbed “digital gold,” has regained its narrative as a store of value in uncertain times.

Institutional reports indicate that the correlation between Bitcoin and gold has strengthened in recent months, underscoring its growing reputation as a hedge asset. This shift is particularly appealing to fund managers looking to balance portfolios amid global volatility.

Future Outlook: Sustained Growth or Short-Term Hype?

Despite the positive momentum, analysts remain divided on whether the current inflows signal the start of a long-term bull market or a temporary reaction to macroeconomic trends.

Optimists argue that the institutional foundation being built through ETFs, custody solutions, and clearer regulations will sustain long-term growth. They cite the continuous entry of blue-chip investors—such as BlackRock, Fidelity, and ARK Invest—as evidence of lasting market confidence.

However, skeptics warn of over-optimism. They point to previous ETF-related rallies that faded once speculative interest cooled. Moreover, potential regulatory challenges, cybersecurity risks, and shifting global monetary policies could temper enthusiasm.

Nonetheless, most experts agree that ETFs have permanently changed the market structure. Whether Bitcoin’s price continues to rise or faces short-term corrections, institutional integration ensures that digital assets are here to stay.

The recent $1.9 billion surge in Bitcoin ETFs boosts crypto market optimism and reaffirms Bitcoin’s growing status as a legitimate financial asset. Institutional participation is no longer speculative—it’s strategic. With clearer regulations, advanced financial instruments, and expanding global acceptance, the crypto market is evolving from its volatile beginnings toward sustainable maturity.

As we move toward 2026, all eyes remain on how these inflows translate into long-term price stability and broader adoption. If current trends persist, the cryptocurrency industry could be entering a new era—one where digital assets stand shoulder to shoulder with traditional investments in global financial markets.